Introduction of iron ore

Iron ore can be regarded as one of the minerals used in mining machinery, it is of great commercial value.

In brief, Iron ore is the ore containing iron or iron compounds. More than 300 kinds of iron-containing minerals have been found in nature, usually, there are three common classification methods in the industry:

The first classification way is according to its chemical composition, that is, the different price points and oxidizing properties of iron elements, and the iron ore can be divided into magnetite, hematite, limonite, and siderite, and these four types of ore are also full of great industrial value under current technical conditions.

The second classification type is according to pH of the ore, which can be divided into the acidic ore and alkaline ore.

In addition, iron ore can be divided into lump ore, fine ore and pellets depending on the diameter.

The factors that affect the use-value of iron ore are mainly including the iron content of the ore, the chemical composition of the gangue, the physical properties of the ore, the pyrometallurgical properties of the ore, and the selectivity of the ore. The grade of iron ore refers to the mass fraction of iron, that’s to say, the amount of iron, which is an essential indicator for determining whether ore can be directly smelted. Iron ore generally less than 50% grade needs to dressing for smelting.

The distribution of global iron ore resource

As we all know Iron ore has abundant reserves in nature and is widely distributed in the world. Global iron ore reserves are mainly concentrated in Australia, Brazil, Russia, and China, and the sum of the reserves of the four countries account for nearly 70% of the world’s total reserves.

The usage of iron ore

The standard for iron ore applied in the mining industry like Hongxing Machinery refers to the average iron content which is generally 25% above. The iron ore is an important raw material for steel enterprises, what’s more, the crushers in Hongxing Machinery can be most suitable for crushing the iron ore, especially the HYDRAULIC cone crushers, and the natural iron ore will be picked out the iron by processes like the crushing, grinding, magnetic separation, flotation, and re-election.

Iron ore can be selected from iron ore by means of a series of equipment, such as the sand and stone equipment plant of Hongxing Machinery

Iron ore is mainly used in the iron and steel industry to smelt pig iron with different carbon content (the carbon content is generally above 2%) and steel (the carbon content is generally below 2%). According to the usage, pig iron is usually divided into the steelmaking pig iron, foundry pig iron, and the alloy pig iron. However, steel can be divided into carbon steel and alloy steel according to the composition elements. Alloy steel is a steel-based on carbon steel that intentionally adds an appropriate amount of one or more elements to improve or obtain certain properties. There are many types of elements added to steel, mainly chromium, manganese, vanadium, titanium, Nickel, molybdenum, silicon.

In addition, iron ore is also used as a catalyst for ammonia synthesis (pure magnetite), natural mineral pigments (hematite, mirror iron ore, limonite), feed additives (magnetite, hematite, limonite) ) and precious stones (magnets), etc., but in small amounts.

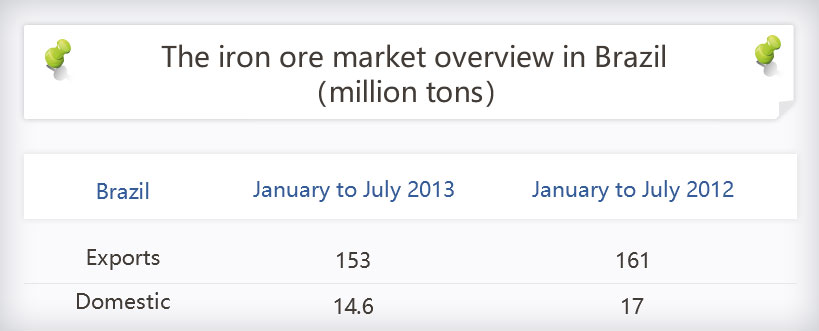

The iron ore market overview in Brazil

Brazil’s Sinferbase data showed that from January to July 2013, Brazil’s iron ore exports reached 153 million tons, compared with 161 million tons in the same period of 2012. During the same period, domestic sales of iron ore in Brazil were 14.6 million tons, compared with 17 million tons in the same period in 2012. Vale’s iron ore sales were 12.9 million tons, followed by MMX, 1.41 million tons and Samarco 297,000 tons.

The iron ore market of Brazil

In generally, Areas that full of iron ore often become large iron ore mining fields.

Brazil’s iron ore resources are very rich, and its main producing area is in the state of Minas Gerais. Among them, Itabiira has the most abundant iron reserves and is known as the “Tieshan Mountain”. Itabira open-pit iron ore is one of the world’s largest reserves of high-grade iron ore. Vale has almost monopolized Brazil’s iron ore production market. Founded in 1942, Vale is the world’s largest iron ore production and export company, the world’s second-largest mining company and the largest mining industry in the Americas. the company. Vale has a 50% stake in MBR and Samitri-Samarku, which have actually controlled the two companies, and most of the iron ore in Brazil is controlled by Vale. At present, the production of iron ore in Vale accounts for about 80% of Brazil’s total national production.

Source image: https://www.viacomercial.com

Brazil’s iron ore reserves rank third in the world, and it is one of the countries with the world’s richest iron ore reserves.

Brazil is also rich in natural resources, and 29 kinds of mineral reserves such as antimony, manganese, titanium, bauxite, lead, tin, iron and uranium are among the highest in the world. The reserves of antimony ore have been proven to be 4.559 million tons, and the output accounts for more than 90% of the world’s total output. The proven iron ore reserves are 33.3 billion tons, accounting for 9.8% of the world, ranking fifth in the world, and its output ranks second in the world. The proven reserves of oil are 15.3 billion barrels, ranking 15th in the world and second in South America!

And its iron ore products are of higher grade, with the lowest aluminum content and other impurities, and the world’s largest iron ore producer, CVRD, comes from Brazil. The largest international market for Brazilian iron ore exports is China and has long been the second-largest country in China’s iron ore imports.

Recently, due to the sharp drop in Brazilian iron ore production, why is this? The Feijo iron ore dam in Brazil was damaged by mines at the end of January. The Vale has closed more than 90 million tons of annual production capacity. The export volume of iron ore exported from Brazil has dropped by 30%-40%, resulting in international iron ore. Prices have risen sharply. We must know that 20% of China’s iron ore is imported from Brazilian iron ore. Therefore, the iron ore in Brazil has plummeted, and China’s iron ore imports have been in crisis!

From the perspective of supply, a data shows that weekly shipments of Australia and Pakistan have fallen to 12.229 million tons, a drop of 47.6% compared with 23.317 million tons in the same period last year. Such a huge contraction has brought great confidence to the market. At the same time, there is not a relatively stable output increase in the global mine supply to replace the reduction of Cuba, resulting in a continuous contraction of iron ore supply, the news of the more exciting iron ore period spot linkage.

In terms of futures, iron ore futures also have presented a beautiful landscape. As of the close of the day on April 3, 2019, the main iron ore 1905 contract on the 3rd was 690.5 yuan/ton up 35 yuan/ton, the highest 694.5 yuan / Tons, the minimum is 660 yuan/ton, the settlement is 680 yuan/ton, the turnover is 2.86 million hands, and the position is 841,000 hands, which has brought a further stimulation to the market.

On the whole, the current iron ore futures rose faster than the spot market, and the basic level continued to be repaired. In view of the previous technical analysis points, iron ore futures still have upside potential, and iron ore is expected to be better. The pressure on the top is 710 points. The spot supply and demand of iron ore continued to improve, and the futures market was expected to be more. It is expected that iron ore prices will continue to show a slight upward trend.

The reason why the price of iron ore has risen recently has been found, but in the medium and long-term, the iron ore has limited rising space, mainly because of the rising space of the resumption of iron ore in the Brazilian freshwater valley.